Blog

Personal Tax Changes for 2021/22: Your essential guide

Posted 4th May 2021 at 11:32 am

In this blog, we outline the key personal tax changes that you need to know about for the tax year 2021/22. Look out for our next blogs detailing the changes to other types of tax this tax year. Income Tax Allowances, Rates & Thresholds The Personal Allowance has been frozen for five years, remaining at £12,570 until April 2026. (Apart from those whose adjusted net income exceeds £125,140, who are not eligible for the personal allowance). The Married Couple’s Allowance has been increased to £9,125 for 2021/22. To be eligible for this allowance, one spouse or civil partner must... Read more

Diversity and inclusion in your organisation

Posted 27th April 2021 at 11:03 am

Businesses are more focused on diversity and inclusion (D&I) than ever before. Addressing the issues of diversity and inclusion not only show that you are a socially-responsible business, but will also be of benefit to you in that you will gain greater understanding of the diverse customer base that you serve. These factors will then make you a more attractive prospect to potential customers and clients, not to mention employees, helping you to further diversify your operations. In fact, a McKinsey research report from 2018 showed that greater diversity in the workforce results in more profitable organisations. While profitability shouldn’t... Read more

Customer Relationship Management

Posted 19th April 2021 at 9:38 am

In this current challenging environment, managing the customers that you already have is the key to stability. Winning new customers when you can’t easily go out and meet people, is challenging to say the least! It also almost always costs you money as well, whether that be marketing spend, or new customer discounts and incentives. Existing customers, on the other hand, already trust your brand and know what to expect from your business, so turning these into repeat customers should be a much easier, and cheaper, task. In order to develop valuable, long term relationships with your customers you... Read more

What is Reddit and how can you use it?

Posted 13th April 2021 at 12:01 pm

You might have heard of Reddit recently, due to the Gamestop share price boom that was largely driven by an investment forum on the site. This hugely popular online forum allows users to create their own forums and chat groups. Reddit combines web content, social news, a social network and a forum into one platform. Registered users of Reddit can contribute to forums with content such as text, video, links or images. All content on Reddit can be voted up or down by other members. This means that the best and most relevant content tends to be voted to... Read more

What are Easter Eggs?

Posted 7th April 2021 at 8:39 am

Easter Sunday has come and gone, and a fair few of us will have indulged in a chocolate egg or two. (Except for accountants, who wait a few weeks until they can pick them up in the sale..) But Easter Eggs aren’t always made of chocolate, and sometimes they’re not even eggs! What are we on about? Well, the term ‘Easter Egg’ is used to describe clues hidden in electronic media such as video. The idea is that viewers look for the hidden clues in the same way children would look for hidden chocolate on an egg hunt, hence the... Read more

Improve performance with feed forward techniques

Posted 30th March 2021 at 5:44 pm

We’ve all been in the situation of either giving or receiving feedback on performance. Nine times out of ten this is never a completely comfortable experience! When we have to hear negative feedback it can make us feel upset, defensive, or angry. Even when our feedback is constructive it can be taken the wrong way, leaving both parties feeling awkward, and making it less likely that improvements to performance will take place. Psychologists have found that most people ‘hear’ negative feedback ‘more’ than positive feedback; we tend to remember with sharp clarity the bad things, and forget about the... Read more

HMRC shows interest in R&D claims

Posted 23rd March 2021 at 12:18 pm

In recent weeks, HMRC have issued a number of informational letters to companies that have previously claimed R&D tax relief. These letters advise companies to check that their previous R&D claims meet the Business, Energy and Industrial Strategy (BEIS) guidelines, and to amend any claims made in error. The letter states that during compliance checks carried out by HMRC there have been particular issues with software claims, because the software claimed for does not create an advance in the field of software development. In addition there have been issues with claims that do not seek to make scientific... Read more

Podcasts: your newest marketing tool?

Posted 16th March 2021 at 11:56 am

Podcasts are recordings of an audio discussion on a specific topic or theme such as business, travel or current affairs. They tend to consist of a series of episodes that listeners can download and listen to via a smartphone or computer. With an estimated 5 billion people around the world owning a mobile device, the potential audience for a podcast is huge. There are around 800,000 active podcasts worldwide. Podcasts are effective marketing tools because they can help businesses to reach a specific target audience. The very best podcasts create value for listeners by being informative, relevant and educational.... Read more

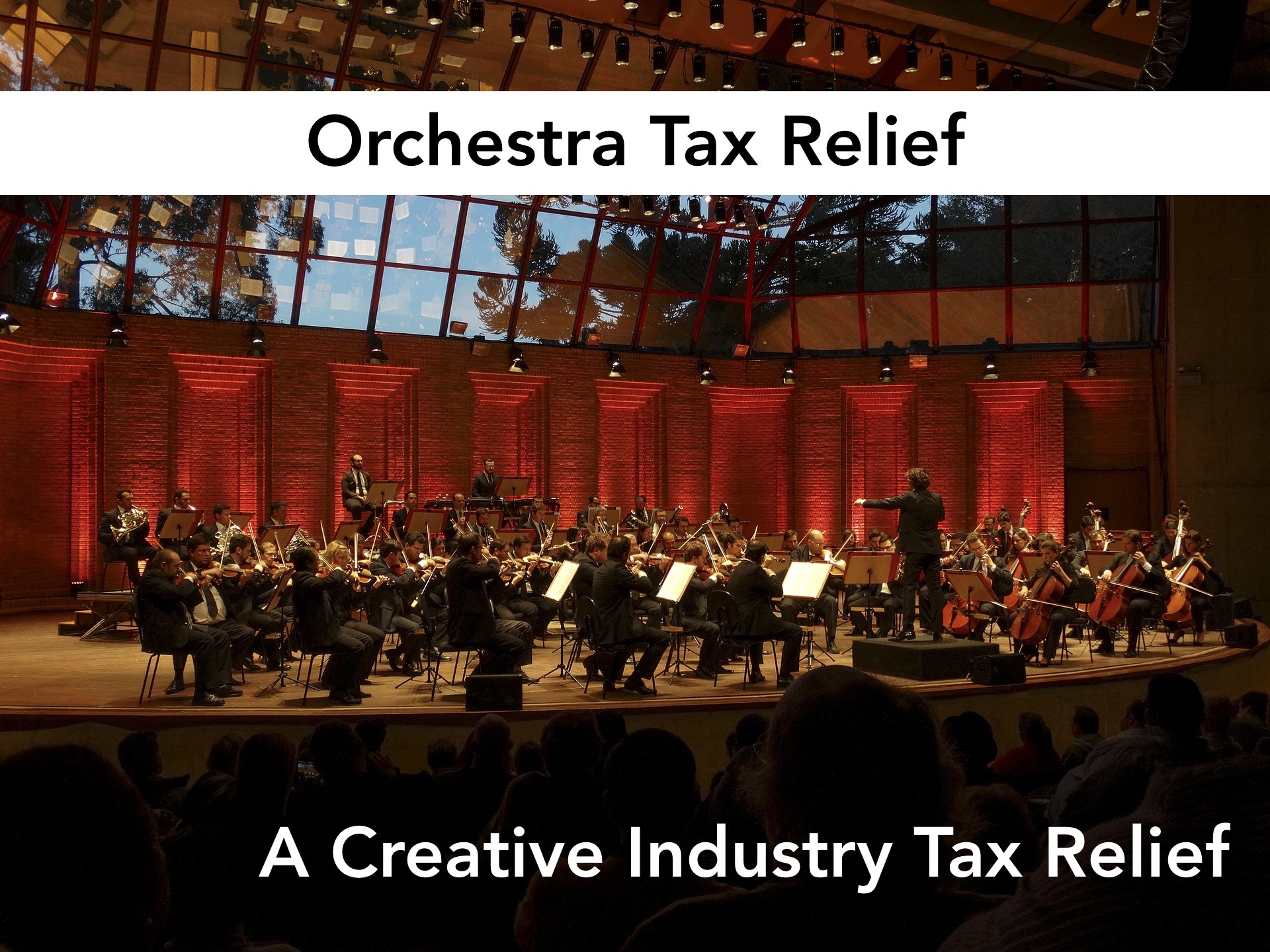

Orchestra Tax Relief

Posted 14th March 2021 at 1:04 pm

Times have been particularly tough for the live music sector over the last 12 months, and particularly so for those organisations who already relied on a combination of public funding and ticket sales to keep them afloat, such as orchestras. With the live music sector hoping for a return to normal by the Autumn, orchestras will be looking for ways to save money, and fortunately there is already a government scheme that can help them to do so. Orchestra Tax Relief is one of the Creative Industry tax reliefs – a group of 8 Corporation Tax reliefs that allow qualifying... Read more

Film Tax Relief

Posted 11th March 2021 at 11:49 am

Even with cinemas closed for long stretches during the pandemic, film companies have been pressing on with creating new releases, many of which have been streamed straight to our homes rather than waiting for a cinema release. Adapting to ‘the new normal’ of filming during Covid-19 has raised production costs, but fortunately there is already a government Film Tax Relief scheme, which can offset some of the core costs of creating a film. This is part of the Creative Industry tax reliefs – a group of 8 Corporation Tax reliefs that allow qualifying companies to increase their amount of allowable... Read more